India New GST Rates 2025: Full Product & Service Update

The India New GST rates 2025 Confused about the new GST rates in 2025? Don’t worry—we’ve simplified everything for you. Here’s the updated list of GST slabs, percentages, and categories so you can understand the changes in seconds.

Overview of India New GST Rates 2025

Under the India GST rate 2025, the system was simplified into fewer slabs. The GST changes in 2025 create more clarity and align India’s structure with global standards.

- Standard Rate (18%) – applies to most goods and services under the new GST rate 2025.

- Reduced Rate (5%) – for mass-consumption items after the India GST rate 2025 update.

- Zero Rate (0%) – key staples exempted under the GST changes in 2025.

- Demerit Rate (40%) – luxury and sin goods taxed higher.

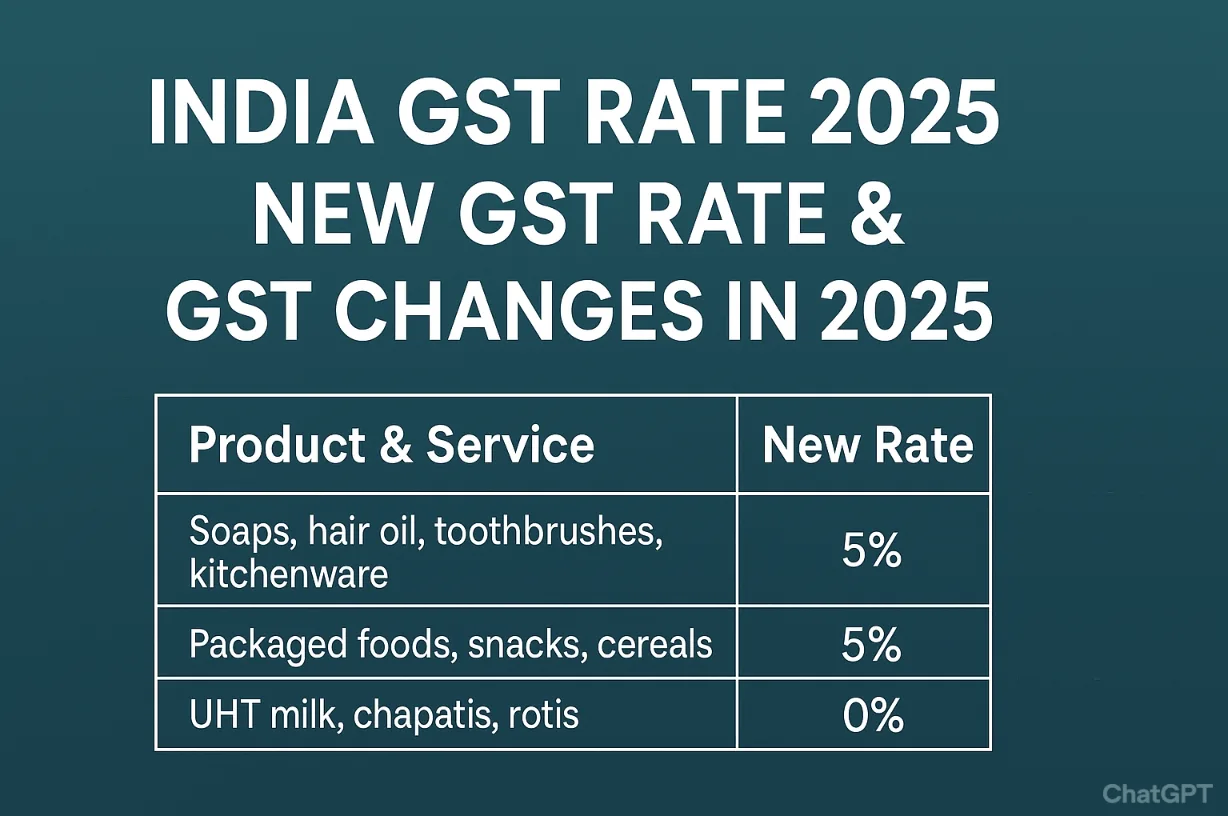

Product And Service Changes in 2025

The new GST rate 2025 reshaped how daily essentials and services are taxed. These GST changes in 2025 especially benefit middle-class households and small businesses.

- Soaps, hair oil, toothbrushes, kitchenware → 12–18% → 5%

- Packaged foods, snacks, cereals, chocolates → 12–18% → 5%

- UHT milk, chapatis, rotis, khakhra → 5% → 0%

- Air conditioners, TVs (≤32 inch) → 28% → 18%

- Cement → 28% → 18%

- Small cars, motorcycles ≤350cc → 28% → 18%

- Salons, gyms, beauty services → 18% → 5% (no ITC)

- Petroleum exploration services → 12% → 18%

- Outsourcing services → 12% → 18%

Product And Service Changes Table – India GST Rate 2025

| Product/Service | Old Rate | New Rate |

|---|---|---|

| Soaps, hair oil, toothbrushes, kitchenware | 12–18% | 5% |

| Packaged foods, snacks, cereals, chocolates | 12–18% | 5% |

| UHT milk, chapatis, rotis, khakhra | 5% | 0% |

| Air conditioners, TVs (≤32 inch) | 28% | 18% |

| Cement | 28% | 18% |

| Small cars, motorcycles ≤350cc | 28% | 18% |

| Salons, gyms, beauty services | 18% | 5% (no ITC) |

| Petroleum exploration services | 12% | 18% |

| Outsourcing services | 12% | 18% |

Impact of GST Changes in 2025

The India GST rate 2025 reform means essential items are now cheaper, while some services are costlier. For businesses, the new GST rate 2025 requires system updates, billing adjustments, and ITC compliance. Overall, the GST changes in 2025 aim to reduce inflationary pressure and boost consumption.

Conclusion

The India GST rate 2025 makes everyday goods more affordable and simplifies compliance. The new GST rate 2025 balances revenue needs with consumer relief, and the GST changes in 2025 are expected to support both businesses and households in the long run.

FAQs About India New Gst Rates 2025

Q1. GST new rate

The new GST rate in 2025 continues with four main slabs – 5%, 12%, 18%, and 28%, depending on the product or service category.

Q2. New GST rates

The latest GST rates in India for 2025 remain at 5%, 12%, 18%, and 28%, with updates in product-wise classification.

Q3. New rate of GST

India’s new GST rates are divided into slabs: 5%, 12%, 18%, 28%, with essentials taxed lower and luxury items higher.

Q4. New GST rate

The updated GST rate in 2025 includes 5%, 12%, 18%, and 28%, as per the GST Council’s notifications.

Q5. New GST rates list 2025

The GST rates list 2025 covers categories under 5%, 12%, 18%, and 28%. Essentials like food are taxed lower, luxury goods higher.

Q6. New GST rates in India

In India, the new GST rates remain slab-based – 5%, 12%, 18%, and 28%, updated as per recent Council meetings.

Q7. Latest GST rates

The latest GST rates include 4 slabs: 5%, 12%, 18%, 28%. Exemptions apply to basic food and essential services.

Q8. GST rates new

The new GST rates in 2025 continue with the same 4 slabs – 5%, 12%, 18%, and 28%.

Q9. GST new rates

GST’s new rate system follows slabs of 5%, 12%, 18%, 28%, depending on product/service type.

Q10. New GST product list

The new GST product list classifies goods into slabs – 5%, 12%, 18%, 28%. Essentials like milk are exempt, while electronics fall under higher slabs.

Q11. Product GST rate

Every product in India is taxed under GST slabs of 5%, 12%, 18%, or 28%, as per government classification.

Q12. What is the new GST rate?

The new GST rate is slab-based: 5%, 12%, 18%, and 28%, applied according to the type of product or service.

Q13. GST rate in India

GST rates in India are divided into 5%, 12%, 18%, 28%, with exemptions on some essentials.

Q14. What are the new GST rates?

The new GST rates in India are 5%, 12%, 18%, and 28%, as announced by the GST Council.

Q15. New GST rates India

India’s GST rates remain unchanged in 2025: 5%, 12%, 18%, 28%, depending on goods and services.

Q16. India new GST rates

India follows GST slabs of 5%, 12%, 18%, and 28%, with few product reclassifications in 2025.

Q17. GST rate new

The new GST rate continues to be slab-based – 5%, 12%, 18%, 28%.

Q18. GST rates in India

GST rates in India are categorized into 4 slabs: 5%, 12%, 18%, and 28%.

Q19. Latest GST rates in India

The latest GST rates in India are slab-based: 5%, 12%, 18%, 28%, with periodic changes by the GST Council.

Q20. GST percentage in India

The GST percentage in India is divided into 5%, 12%, 18%, and 28% slabs.

Q21. 2025 new GST rates list

The new GST rates list 2025 continues with the same 4 slabs: 5%, 12%, 18%, 28%.

Q22. 2025 GST rate list

The GST rate list 2025 covers categories under 5%, 12%, 18%, and 28% slabs.

Q23. New GST rate in India

The new GST rate in India includes 5%, 12%, 18%, and 28%, with essentials exempt.

Q24. New gat rate

The correct term is “new GST rate” – slabs are 5%, 12%, 18%, 28%.

Q25. New GST charges

The new GST charges are calculated based on slabs of 5%, 12%, 18%, 28%, depending on the product/service.

Q26. GST slab 2025

The GST slab 2025 continues with 5%, 12%, 18%, 28%, with periodic product updates.

Q27. What is new GST rate?

The new GST rate follows slab categories of 5%, 12%, 18%, 28%.

Q28. New GST rate chart

The GST rate chart shows 4 slabs – 5%, 12%, 18%, 28%, applied product-wise.

Q29. New GST rates list in India

India’s GST rates list includes 5%, 12%, 18%, 28%, updated by the GST Council.

Q30. GST rate on products

Products in India are taxed under GST slabs of 5%, 12%, 18%, or 28%, based on category.

Q31. GST 2025

In 2025, GST continues with 4 slabs: 5%, 12%, 18%, 28%, with few product revisions.

Q32. GST ki new rate

GST ki nayi rate 5%, 12%, 18%, aur 28% slabs me hai.

Q33. GST ki rate

GST ki rate 2025 me 5%, 12%, 18%, aur 28% hai.

Q34. Latest rates of GST

The latest GST rates are slab-based – 5%, 12%, 18%, 28%, depending on goods/services.

Q35. Milk GST rate old and new

Milk is GST-exempt (0%) both in old and new GST rate lists.

Q36. New GST rate on electronic items

Most electronic items fall under the 18% GST slab in 2025.

Q37. New GST rates all products

The GST rates for all products are divided into 5%, 12%, 18%, 28% slabs.

Q38. New GST rates for all products

All products in India fall under GST slabs of 5%, 12%, 18%, 28%, updated by category.

Q39. New GST ret

The correct term is “new GST rate” – slabs: 5%, 12%, 18%, 28%.

Q40. Products GST rate

Each product in India is taxed under GST slabs of 5%, 12%, 18%, or 28%.

Q41. Recent GST rates

Recent GST rates in 2025 continue with 5%, 12%, 18%, 28% slabs.

Q42. TV new GST rate

Televisions generally fall under the 18% GST slab in 2025.

Q43. All new GST rates

The new GST rates include slabs of 5%, 12%, 18%, 28%.

Q44. Gat new rate

The correct term is GST rate – 5%, 12%, 18%, 28%.

Q45. GST changes 2025 in Hindi

2025 me GST slabs wahi hai: 5%, 12%, 18%, aur 28%, kuch product categories me chhote updates hue hain.

Q46. GST chart 2025

The GST chart 2025 includes slabs of 5%, 12%, 18%, 28%, with category-wise classification.

Q47. GST new rate list 2025

The GST new rate list 2025 follows 4 slabs – 5%, 12%, 18%, 28%.

Q48. GST new ret

The correct term is GST new rate – slabs of 5%, 12%, 18%, 28%.

Q49. GST new slab 2025

The new GST slabs in 2025 remain: 5%, 12%, 18%, 28%.

Q50. GST new slab 2025 list

The GST new slab 2025 list includes all four GST slabs: 5%, 12%, 18%, 28%.